Sector Allocation Help

This XML file does not appear to have any style information associated with it. The document tree is shown below.FundsLibrary uses the ICB sector breakdown for sector classification.

About ICB

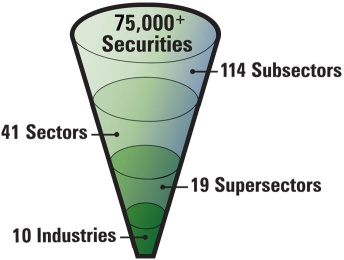

The ICB structure for sector and industry analysis enables the comparison of companies across four levels of classification and national boundaries. It offers a balance between levels of aggregation, for those who look at markets from the top down, and granularity, for those who look at markets from the bottom up.

Each company is allocated to the subsector that most closely represents the nature of its business, which is determined by its source of revenue or where it constitutes the majority of revenue.

- 114 subsectors allow detailed analysis.

- 41 sectors provide a broad benchmark for investment managers.

- 19 supersectors can be used for trading.

- 10 industries help investors monitor broad industry trends.

Equity and Balanced Funds

ICB sectors only apply to equities. Where a fund holds a proportion of equities and a proportion of fixed interest (or other) securities, those additional elements are also analysed to provide greater detail. For example, 70% of the fund is in equities so that is split into the appropriate ICB sectors. The remaining 30% is in fixed interest holdings so those get split down into:

Bonds:- Government

- Investment Grade Corp Bonds

- High Yield Corporate Bond

- Asset Backed securities

- Mortgage Backed securities

- Non-Classified Bonds (bonds that can't be classified into the list above)

- Commodities

- Alternative Trading Strategies

- Property

- Managed Funds (where underlying data is not available)

- Cash and Equivalents

Fixed Interest Funds

Where a fund holds exclusively Bonds then a Bond Sector Breakdown is shown instead. In this situation corporate bonds are mapped to their parent equity and then into their sectors. For example, a corporate bond issued by BP is mapped back to BP and lands into the Oil Gas sector. If the fund has other bond holdings (i.e. not corporate bonds) then the following detail is provided:

- Government

- Asset Backed securities

- Mortgage Backed securities

In addition, any residual holdings in equities are grouped together as equities (they are not split into their sectors) and other assets are classified appropriately as follows:

- Equities

- Commodities

- Alternative Trading Strategies

- Property

- Managed Funds (where underlying data is not available)

- Non-Classified Bonds

- Cash and Equivalents